Author: Rafael Gómez / 5 minutes read.

At Revenue Resort we try to analyze the key issues facing hotels to restart their activity.

We analyze it considering the information we have today from an analytical and critical perspective:

What is the progress for air transportation?

As we already commented in previous posts, the financial impact on airlines has been so great that some cannot continue the operation and their national governments rescued other companies.

The latest report from IATA (International Air Transport Association) indicates that airlines lose almost 95% of business compared to previous years, have seen recently a slight sign of recovery with the progressive restoration of air connectivity.

An important factor for airlines has been that they do not have to keep safe distance, as this would affect profitability and would certainly influence prices.

It is worth mentioning that this demand is mainly coming from the national markets at the moment. Looking at the most recent communications received, we can highlight the following:

- Iberia and Vueling announced that they will get back and restore part of their schedule for domestic and European flights in July.

- Air Europa will also start their domestic flights from June 22 and will gradually increase the European and transoceanic operations from mid-July.

- The Government of the Canary Islands and Binter expand inter-island air connections to adjust them to the economic recovery.

- Ryanair announces that it resumes flights to Spain on July 1.

- KLM Royal Dutch Airlines will start from July to 5 Spanish destinations: Alicante, Bilbao, Ibiza, Malaga and Valencia. These destinations are on top of the already existing offer from Madrid and Barcelona.

- Likewise, the vast majority of charter flights will start operating slowly, giving priority to the destinations with higher demand to test and analyzing results, adapting their strategy to this new reality.

What demand and occupancy can we expect?

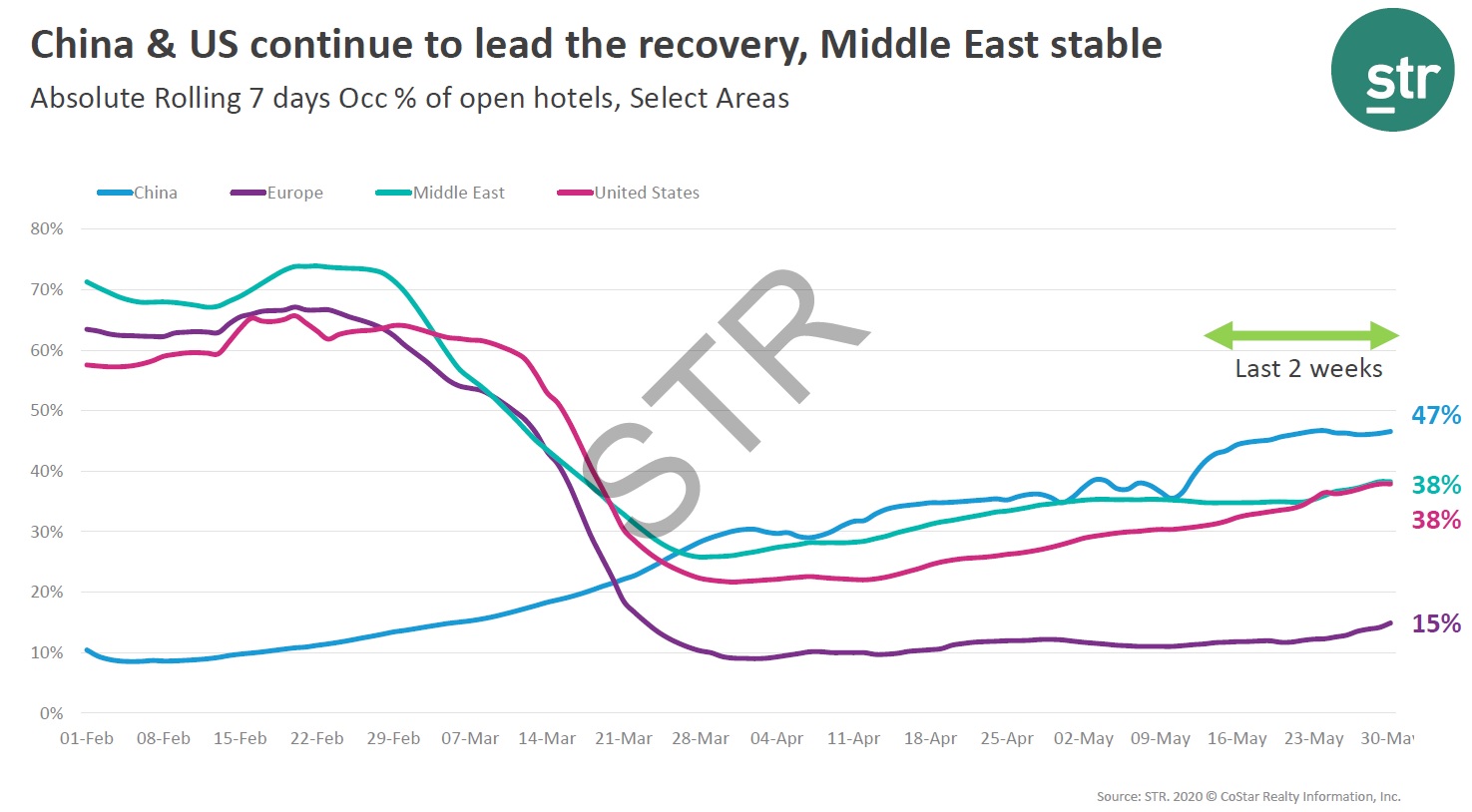

According to the latest STR report (Smith Travel Research), in the last 2 weeks, China increased 10 occupancy points, standing at 47% and showing a positive trend. Only at the end of May, we see a new trend in Europe with slight growth, increasing occupancy by 5 points.

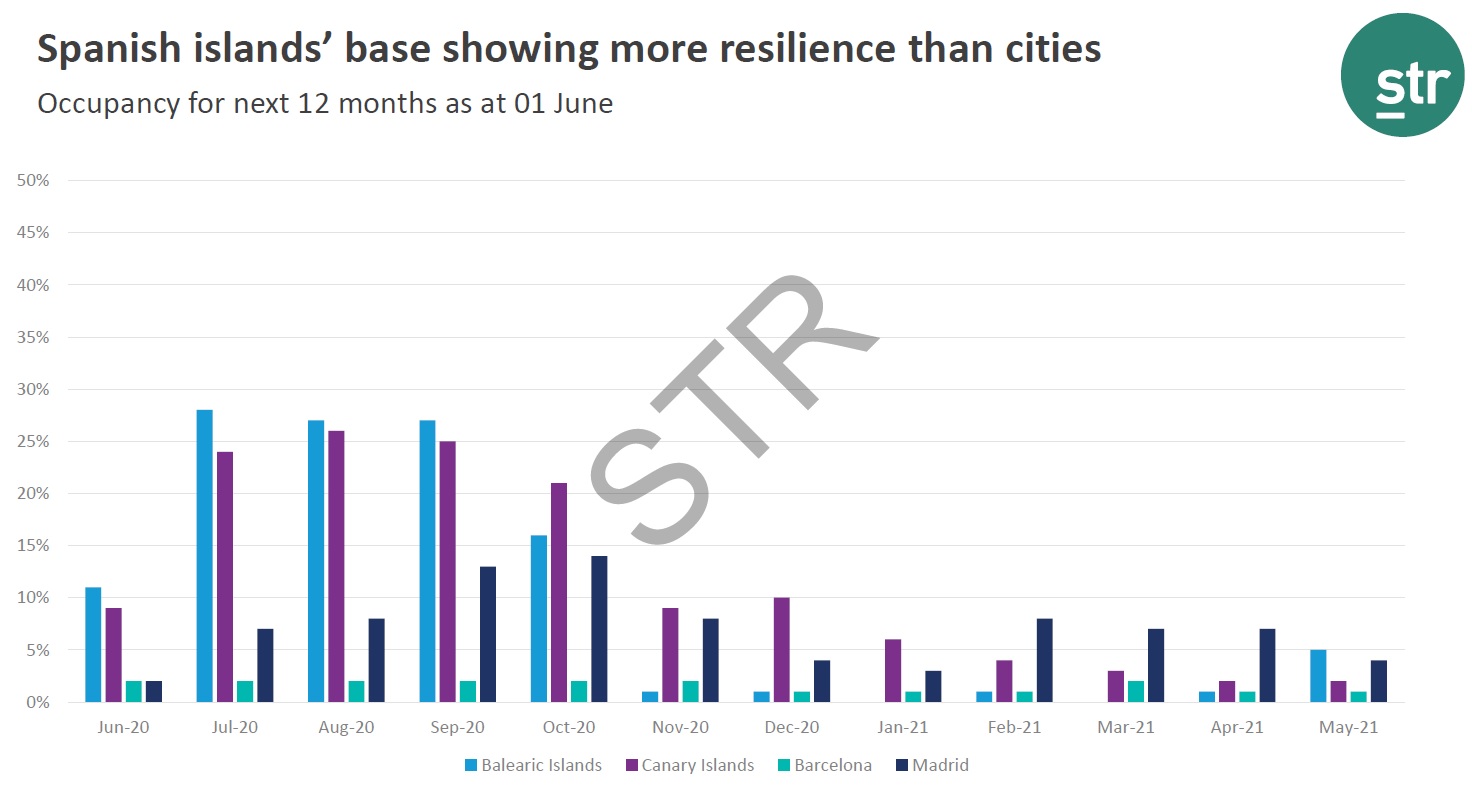

From Revenue Resort we focus on Resorts, so we want to draw the map on the islands and specifically, in the Canary Islands where we are located. STR For this destination shows in its report of June 1st, that from July to September occupancy OTB (On The Books) is around 25%.

When can we get back to pre-COVID-19 results?

This is the one million question! As we never had in a global pandemic in the recent past, it is difficult to measure the impact that security will have to flights and hotel accommodation mainly for short and mid-term. CEOs of the main hotel companies comment that until 2023 we will not have the same occupancy levels again. However, seeing the progression of China we can forecast what our “possible occupancy curve” could be.

In a previous post, we talked about “blue thinking” and the analytical and critical thinking, this is crucial to be able to recover faster than the competitors and gain market share.

With this information in mind, when could be the best opening date?

Although several weeks ago no one could confirm a specific date, the truth is that we are getting information from the airlines schedule, which is the main decision factor specially for tourist destinations. The government activated free movement for the European Union from July 1, being key to start thinking in a possible opening date.

Now, in each hotel there is a different reality and profitability point. Therefore, the logical opening date should take place when the “forecast” estimated based on existing reservations (considering possible cancellations), and a realistic pick-up, can compensate existing expenses. Hotels should look for their “break even” point. This point of balance should indicate the most realistic date for each Hotel considering that each hotel has a different reality.

What actions do we recommend for the hotels?

From Revenue Resort, based on actual existing information we currently recommend the below actions:

- Follow scrupulously the cleaning protocols, disinfection and minimum distance actions and make them public, including the health certificate. It will be crucial for the hotel and will be one of the most important factors for online reviews. A bad review related to security measures will seriously affect the hotel performance.

- Ensure training for all associates, especially in hygiene and cleaning protocols.

- Change the traditional buffet concept, adapting it into a la carte service or a single-dose buffet, analyzing its costs and opportunities.

- Use hotel database to reach the clients and make a reopening offer focused on the national market for short term, considering the lack of international flights.

- Make added-value promotions instead of dropping your rates.

- Analyze the new trend since the end of May and how is the booking curve evolution for your property. Update your forecast to show this last trend.

- Plan an opening strategy, gradually recovering the ERTE staff and adjusting the hotel operation to the estimated forecast, analyzing expenses for both situations, hotel closed and open using different scenarios.

- Do marketing campaigns and ensure a correct positioning for the direct channel.

- Look for new opportunities coming from this situation (there are always new opportunities), and plan actions that will also help the long term. These may come from new emerging markets, new market niches, new services, and even a different operation by season looking to increase your GOP.

- Finally, never make quick decisions that may have a negative impact to your future profitability (long-term strategy thinking).

From Revenue Resort we wish you all the best for the opening period and best wishes to get back to a certain operation normality.